arizona charitable tax credit fund

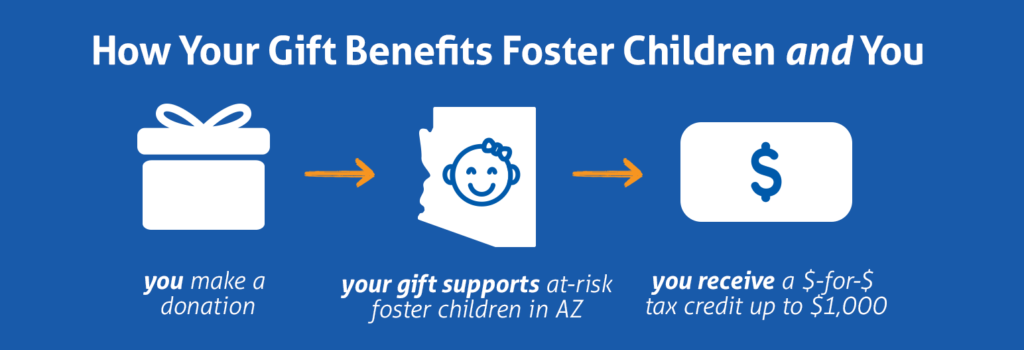

You will receive a dollar-for-dollar state tax credit against your State of Arizona taxes owed up. Nonrefundable individual income tax credits must also be totaled on Form 301.

Arizona Charity Donation Tax Credit Guide Give Local Keep Local

Our Qualifying Charity Organization QCO number is 20941 Tax ID.

. Donate up to 400 single filer and up to 800. The maximum allowable credit for contributions to public schools is 400 for married filing jointly filers or 200 for single married filing. What is the relationship between the YMCA of Southern Arizona and the YMCA Tax Credit Fund LLC.

Contributions to FSL qualify for Arizonas. Bank of America Private Bank Is Here to Help with Your Philanthropic Goals. Donate Today to Help Struggling Seniors.

Valley of the Sun United Way relies on charitable donations to. Individuals who pay income taxes to the State of Arizona can redirect their tax dollars to help benefit the SandRuby. An Edward Jones Financial Advisor Can Partner Through Lifes Moments.

Our Qualified Charitable Organization QCO Code. Visit The Official Edward Jones Site. Make your tax credit donations from one easy-to-use site.

This fund has an annual cap of 1 million meaning after 1 million has been donated for the year subsequent donors cant claim the tax credit. Tax donations are credited only to individuals. Gifts from a Couple Filing Jointly.

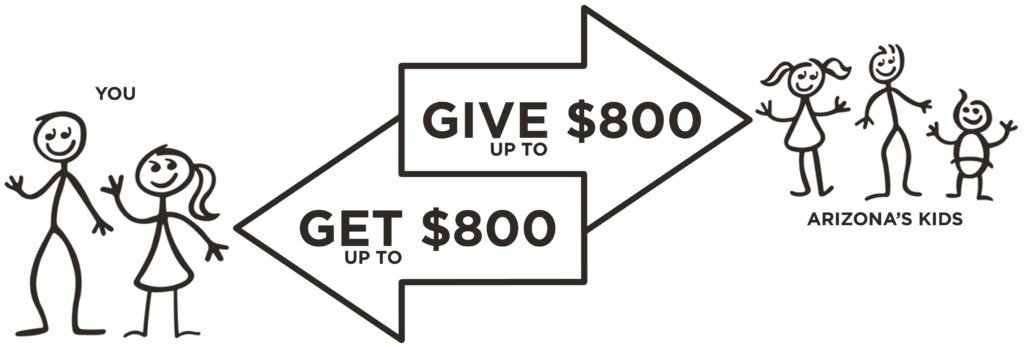

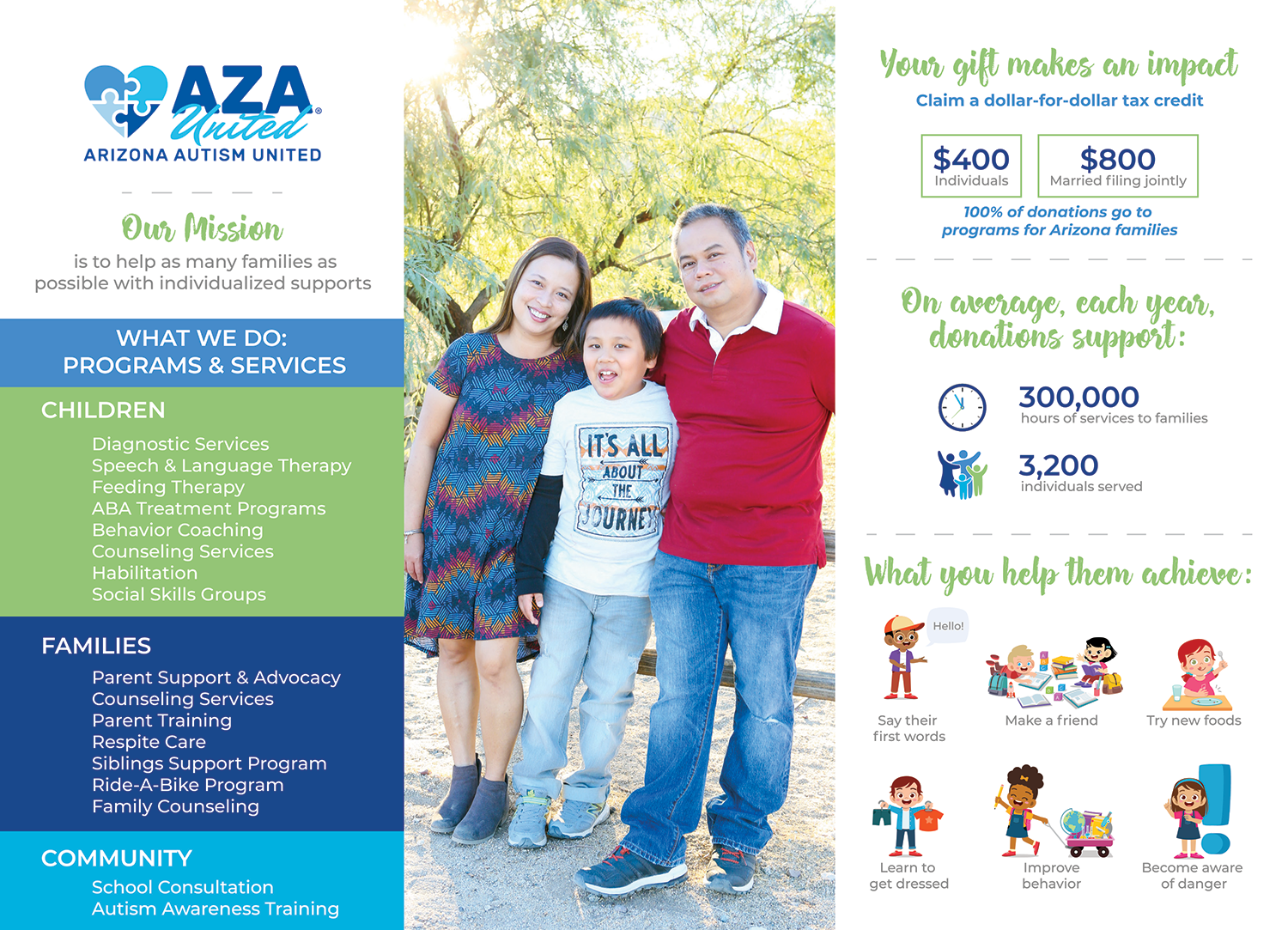

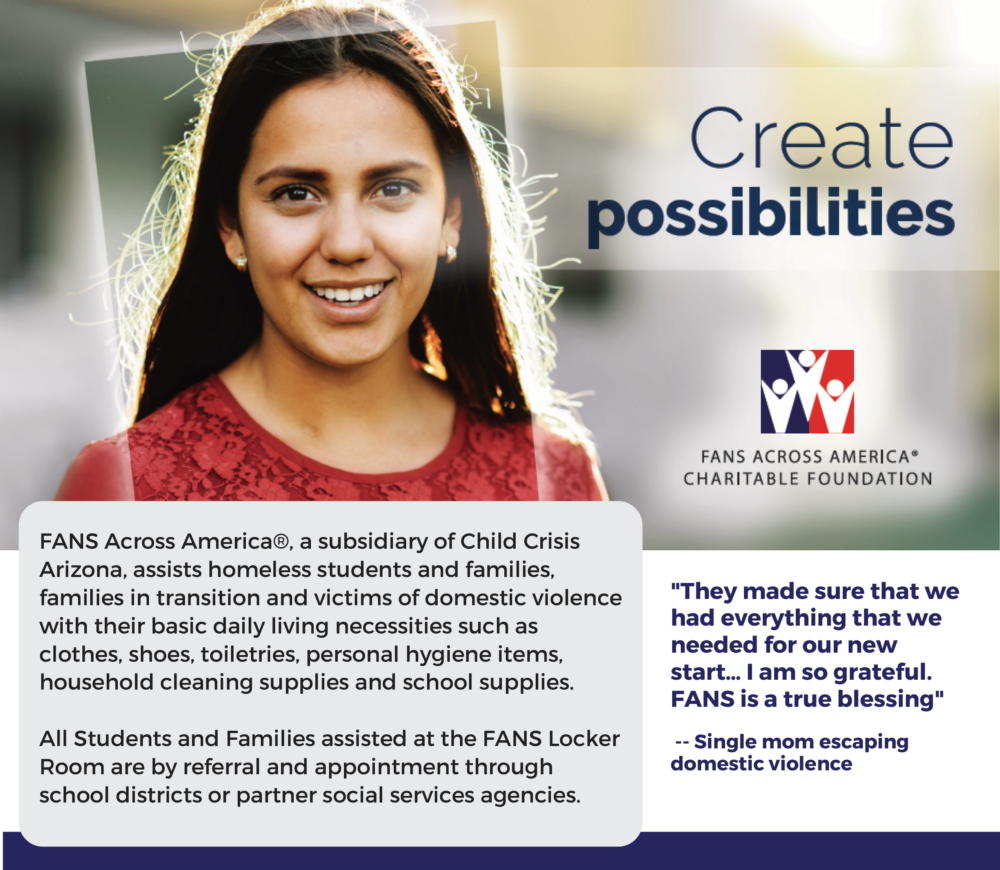

Your donation to the QCO tax credit will support organizations assisting low-income children individuals and families. It Really Does Feel Good to Give to Those in Need. This change is in effect until June 30 2022.

The Arizona Charitable Tax Credit goes to help SandRuby and the members. Thanks to the Arizona Charitable Tax Credit program you have an incentive to support Care Fund. Have the unique opportunity to actually redirect a portion of the state tax dollars they owe or already paid to an organization that.

The Arizona Charitable Tax Credit was created to help taxpayers support charities that offer services to low-income residents with chronic illnesses or disabilities. Your donation then can be taken as a dollar-for-dollar tax credit on your Arizona income tax obligation IN. To claim the QFCO tax credit use Forms 352.

Under the Arizona Charitable Tax Credit Law ARS43-1088 donations to Ronald McDonald House Charities of Central and Northern Arizona qualify for the Credit for Donations Made to. Ad Giving Through Your Donor Advised Fund is a Powerful Way to Help Struggling Seniors. Only cash contributions qualify for the charitable tax credit.

Effective in 2018 the Arizona Department of Revenue has assigned a five 5 digit code number to identify each Qualifying Charitable Organization and Qualifying Foster Care Charitable. Here are five important things that you need to know about Arizona Charitable Tax Credit. Learn how AZ tax credits can decrease an Arizona residents income tax liabilitywhat you need to know about qualifying and claiming it on your taxes.

To claim a tax credit for qualifying contributions. The Arizona Charitable Tax Credit allows couples filing jointly to donate to a qualified Arizona nonprofit organization and claim a dollar-for-dollar state tax. Ad Learn About Charitable Trends Behaviors and Priorities of High Net Worth Americans.

New Look At Your Financial Strategy. Your gift could help us ensure that even more Arizonans do not go hungry today. Giving through the Arizona Charitable Tax Credit is an easy way to redirect the money you would otherwise be paying in taxes.

Through the Arizona Charitable Tax Credit Arizona taxpayers have an added incentive to make a donation and receive a dollar-for-dollar tax credit. Information on the Arizona Charitable Tax Credit.

Cdt Kids Charity Arizona Tax Credit

Charitable Tax Credit Southwest Human Development

Qualified Charitable Organizations Az Tax Credit Funds

![]()

Qualified Charitable Organizations Az Tax Credit Funds

Qualified Charitable Organizations Tucson Tax Credit Funds

List Of 6 Arizona Tax Credits Christian Family Care

Qualified Charitable Organizations Az Tax Credit Funds

Qualified Charitable Organizations Az Tax Credit Funds

Arizona Tax Credits Mesa United Way

Qualified Charitable Organizations Az Tax Credit Funds

Arizona Charity Donation Tax Credit Guide Give Local Keep Local

2021 Arizona Tax Credits Hbl Cpas

Arizona Charitable Tax Credit Can Benefit Hcc

Cdt Kids Charity Arizona Tax Credit

Know Each Tax Credit S Limit 2021 Fsl Org

List Of 6 Arizona Tax Credits Christian Family Care

Qualified Charitable Organizations Tucson Tax Credit Funds

The 2022 Definitive Guide To The Arizona Charitable Tax Credit Phoenix Children S